New York

Western New York Portfolio

Sites Features

283 units in 14 properties with a mix of one-, two-, and three-bedroom units.1

Variety of settings, including garden-style, townhome suburban, and street-front urban.

Thesis

Assembled a value-add multifamily portfolio in several off-market transactions over a period of approximately 3 years in key growth markets in western New York. Built an operating business, with several full-time staff members and back-office infrastructure to support the execution plan. Repositioned the assets through strategic capital investment and sold the updated portfolio realizing more than 10% over initial underwriting metrics.

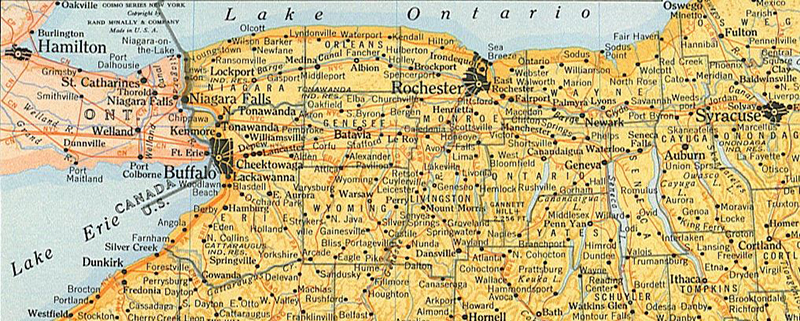

Location

- Western New York

Purchase Price

-

$13.6 million (cumulative) / $48,240 per door (ave)

Capital Investment

- $1.15 million (cumulative) / $4,000 per door (ave)

Sale Price

- $19.5 million (cumulative) / $69,000 per door (ave)

Gross Levered LP IRR

-

33.6% per year, average over the hold period2

LP Equity Multiplier

-

2.18x over the hold period (ave)

Hold Period

- 2 years and 10 months (ave)

Project Status

Closed in 20243

1 One 10-unit property is mixed-use retail and residential.

2 7% annual coupon was paid on 165 doors for the duration of the hold.

3 One 16-unit property is pending sale.