Taking value creation to the next level: custom real estate businesses

In 2013, our managing partners were approached by a family office that was interested in capitalizing on the distressed state of the real estate markets in the US at that time. The family office had no particular plan or direction in that regard, but had strong intent and ready-to-deploy capital. After a 30 minutes

conversation, it became clear that this organization was not seeking a traditional investment vehicle. Rather, they wanted to “own the game” and have full control and autonomy of their new venture. More than just a portfolio of assets, they wanted an integrated real estate investment arm that would complement their existing portfolio of infrastructure and natural resource assets.

Our managing partners were engaged, key objectives were agreed upon and an execution plan was put in place within 6 weeks. Within 36 months, this family office had a fully staffed operation with $73 million of quality mixed use assets in the US Sunbelt under ownership and management. The new real estate entity was generating an Internal Rate of Return (IRR) of over 32% in its 3 rd year. Importantly, When our managing partners were satisfied that all of the key objectives were achieved, the correct management team was retained and a 1-3-10 year plan was signed, sealed and delivered, they existed this business in 2018. It was fully autonomous. Now, the real estate business of this family office has over $300 million of assets under ownership and management. The key was to build a proper foundation and then set it on the right path.

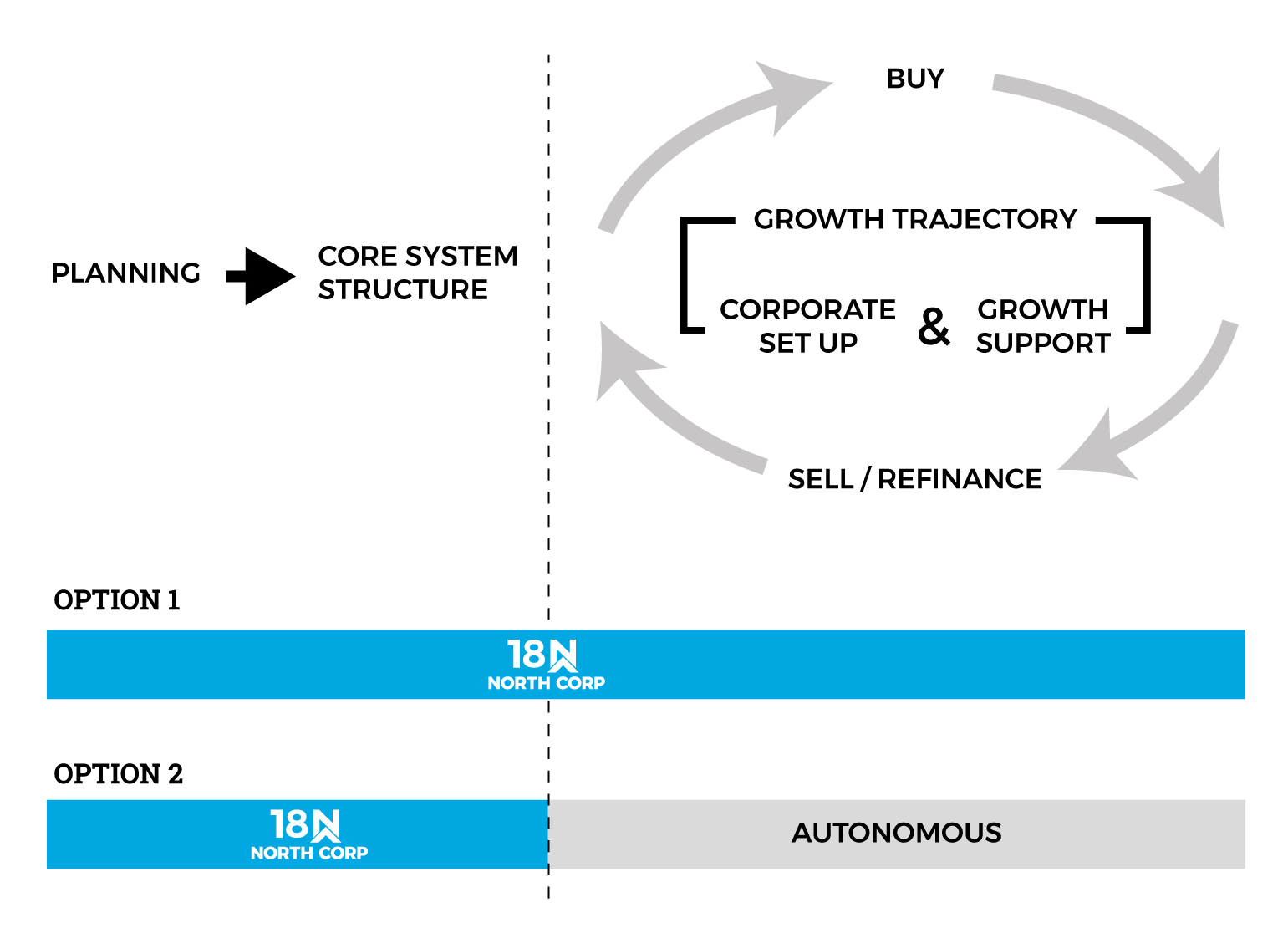

While the objectives of every partner are different and unique, the following offers a broad idea of how we build real estate businesses from the ground up

Setting of vision, objectives, timelines and desired outcomes.

- Refinancing/disposition

- Stakeholder compensation

- Permanent debt (if needed)

Establishing the administrative and regulatory functions of the company, including:

- Registrations

- Payroll

- Key processes & procedures

- Initial tax structure

Selective integration with existing parent company processes, if such exist.

Property acquisitions: ongoing and starts immediately upon corporate set up.

Staffing: strategic and ongoing

- Recruiting

- Onboarding

- Training

Capital reinvestment: will be informed by the business development plan:

- Property improvements & repositioning

- Development/redevelopment

- Proactive Asset management: informs the business development plan

- Regular reporting & progress updates: highly customizable

- Succession planning

- Tax planning

- Insurance

Option 1 – 18 North stays as partner in the business (scope to be defined)

Option 2 - 18 North exits when business is fully autonomous

- Helping to create a 1-3-10 year plan

- Ensuring that the right people are empowered to lead the organization forward